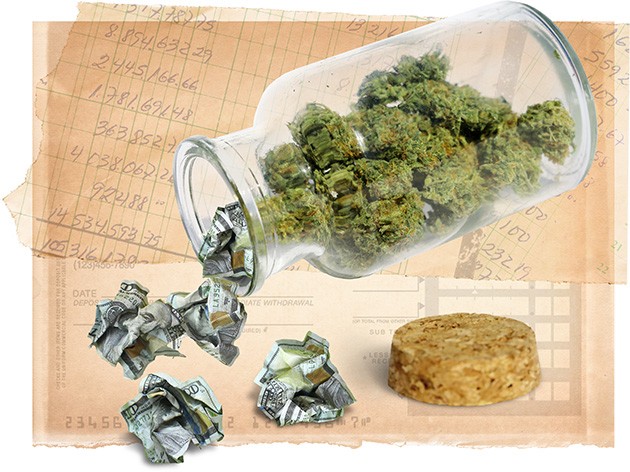

Oklahoma’s medical cannabis industry is roaring, with more than $1 million in tax revenue collected in April. But federal prohibition makes headaches for entrepreneurs and professionals.

Oklahoma’s medical cannabis-related businesses must operate without access to traditional banking due to federal law. || Ingvard Ashby

By Matt Dinger

Medicinal cannabis has been legal in Oklahoma for just over half a year, and this train has no brakes.

Based on computations stemming from the amount of gross state tax collections of 7 percent, the industry has raked in over $18.1 million in April alone.

That means a total of more than $43 million since Oct. 26, the first day cannabis containing THC became legal.

It was only four months to the day more than half a million Oklahomans voted yes on State Question 788 and the date that products, including raw flower, could be sold to licensed patients.

Because of that, the first full month of sales brought little tax revenue. Oklahoma Tax Commission (OTC) reported $1,343.09 in tax revenue collected from Oct. 26 to Nov. 20. The last reporting date of each month is the 20th.

The industry brought in $69,425.81 in the second month of tax collection. It did not take long for those numbers to climb into the triple digits. In January, more than $305,000 was collected, with more than $497,000 in February and $870,000 in March, according to tax commission records.

April brought in the first million-dollar month in taxes, with more than $1,271,000 in gross collections by the state, and legal cannabis in Oklahoma has deposited just over $3 million in state coffers as of April 20.

That money came from 108,696 patients, 1,398 caregivers, 2,819 growers, 1,445 dispensaries and 782 processors whose licenses were approved by May 6, according to Oklahoma Medical Marijuana Authority (OMMA).

All of the tax revenues are initially deposited into a designated fund at the state health department until the annual budget for OMMA, set at $5.8 million for 2019, is filled. After that, 75 percent of the remaining tax revenue goes to the state’s general revenue fund and 25 percent goes into the department’s Drug and Alcohol Rehabilitation Fund until the end of the fiscal year on June 30 when the budgetary collections for OMMA begin anew, according to OTC spokeswoman Paula Ross.

“280E was built to curtail illicit drug runners, not necessarily to curtail business in states where it’s legal and people are doing it the right way.”— Lawrence Cagigal

“The marijuana money is all a cash business, but the tax, we don’t necessarily have to just have cash. That being said, that still didn’t prevent a lot of people because of how they’re running their business and having a lot of cash when they make their payments,” Ross said. “Obviously, it’s growing at a very rapid pace, so we knew this was going to get larger. Every month, it’s just doubling and tripling, so we basically were doing all types of things, and then this came up with BancFirst.”

Starting May 1, cash payments for medical cannabis and associated withholding and sales tax accounts can be made in person at any BancFirst location during regular banking hours. A convenience fee of $25 applies to each transaction, regardless of the amount.

BancFirst is chartered by the state of Oklahoma.

“We felt like this opportunity gave people across the state somewhere where, although they pay a convenience fee, it’s still a lot easier than driving across the state to actually have to make the payment at the tax commission,” she said. “This is obviously — no pun intended — a growing industry, and so right now, we’re seeing that each month, we’re getting more and more. So we were pretty ready for the first payments, but we are realizing that we have to see how things are going and what’s necessary to be efficient for the people coming in to pay the taxes and just the industry as a whole. And then when we collect taxes, just so we can remit them properly and get things running efficiently.”

Over the years, fewer and fewer businesses paid their tax obligations in cash, so the commission has seen an influx of foot traffic and has increased security and updated its protocols for moving the money.

“I think that industry is trying to figure out their banking issues, and they’ve obviously talked to us about it, so a lot of that those payments do come in in cash,” Ross said. “Although, like I said, with the tax, it’s not quite as strict as just the marijuana payment, but we still did get a lot more cash.”

But those figures only account for the 7 percent state excise tax on cannabis and not for state and local sales taxes also collected by businesses.

Enforcement issues

In Oklahoma City, sales taxes have brought in just over $180,000 in revenue. The steep incline follows the same trajectory as gross collections by the state, with more than $17,000 collected in January, $36,000 in February, $54,000 in March and $66,000 in April, according to figures from the city treasurer.

“There isn’t a standard business code classification for these businesses, so they tend to be reported in our sales tax data under various industry codes. As a result, we extract our numbers based on the business name and location from licensing information. Although the numbers are very accurate, they may not be exact in cases where their sales tax permit information varies from their state license,” city treasurer Bob Ponkilla wrote in an email. “To put in perspective, the April total of $66,436.73 represented about 2/10 of 1% of the City sales tax collections for that month.”

While acting in accordance with state law is not a challenge, cannabis is still classified as a Schedule 1 drug by the Controlled Substances Act, which means that the industry does not have easy access to the federal banking system and products cannot be sold or transferred between states.

However, the Rohrbacher-Farr Amendment was adopted in 2014 and prohibits the Department of Justice from using any congressionally delegated funds to prosecute businesses in good faith compliance with their states medical marijuana laws. It continues to be updated as more states adopt medical cannabis.

“The average client is basically dealing with strategies either to secure their cash and store it in a secure manner or, alternatively, to get that money back into the business.”— J. Blake Johnson

Along with the “Cole Memo,” which gave federal prosecutors guidelines on who can and cannot be prosecuted in state cannabis markets, dispensaries, growers and processors are left largely to their own devices so long as they abide by certain guidelines, which include not distributing to minors, funneling revenue to criminal enterprises and diverting it to states where it is still illegal. The Cole Memo was released in August 2013, was rescinded by Attorney General Jeff Sessions and still has not been reinstated, but there have been no major law enforcement actions in contradiction to the Cole Memo since it was rescinded.

On May 8, 33 attorneys general — including Oklahoma attorney general Mike Hunter — signed a letter addressed to Congressional leaders.

“We urge Congress to advance legislation that would allow states and territories that have legalized certain use of marijuana to bring that commerce into the banking system. This issue is of broad relevance: for example, thirty-three states and several U.S. territories have legalized the medical use of marijuana. However, because the federal government classifies marijuana as an illegal substance, banks providing services to state-licensed cannabis businesses and even to other companies which sell services and products to those businesses could find themselves subject to criminal and civil liability under the federal Controlled Substances Act and certain federal banking statutes. This risk has significantly inhibited the ability of financial institutions to provide services to these businesses and companies. Despite the contradictions between federal and state law, the marijuana industry continues to grow rapidly. Industry analysts estimate 2017 sales at $8.3 billion and expect those totals to exceed $25 billion by 2025. Yet those revenues are handled outside of the regulated banking system. Businesses are forced to operate on a cash basis. The resulting grey market makes it more difficult to track revenues for taxation and regulatory compliance purposes, contributes to a public safety threat as cash-intensive businesses are often targets for criminal activity, and prevents proper tracking of billions in finances across the nation,” the letter states.

Creative cash

J. Blake Johnson specializes in cannabis law. The former co-chair of Crowe & Dunlevy’s Cannabis Industry Practice Group is now a partner in Overman Legal Group. He helps cannabis businesses play by the rules.

“The federal prohibition is, on a day-to-day level, not a huge challenge. At least, I should say, we don’t fear prosecutions because we’re complying with the law at the state level,” Johnson said. “But certainly the federal prohibition results in challenges of a more practical kind: limited access to banking, basically no access to financing or lending. And if you’re just a business person who’s interested in entering a sort of burgeoning industry like this, you’re likely to think, ‘Well, I’ll be able to get a loan from the bank to finance this project and that same bank will accept my deposits.’ And, of course, as a practical reality for our industry, neither of those is ordinarily the case.”

Johnson also recently founded Climb Collective, which seeks to help businesses navigate some of those hurdles in creative but legal ways.

“The marijuana money is all a cash business, but the tax, we don’t necessarily have to just have cash.”— Paula Ross

“For some clients, Climb has developed some pretty creative strategies to secure financing, whether institutional or third-party. On the deposit level, there are a couple of banks in the state that are open to the industry. But the average client is basically dealing with strategies either to secure their cash and store it in a secure manner or, alternatively, to get that money back into the business, which is the most common scenario. Or alternatively, to invest that cash in one or another areas that are more accepting of cash investment,” Johnson said. “There are certainly some real estate investments where the seller might be open to cash payments. And, of course, we’re talking about clients that are able to demonstrate that the cash is legitimately earned through a lawful business enterprise. I have heard, for example, of dispensaries that use ATMs to stock it with their own cash in order to get some part of their cash back into a banking account. At the stage that the industry is at its evolution, I think most businesses are probably still reinvesting their revenue into the business itself.”

While BancFirst handles tax payments for the industry, there are few options for banking the bundles of cash that businesses end up with when patients come to purchase products. While the money is earned in legal ways, most banks still will not touch the money, though there are exceptions.

“First Fidelity was the first bank that that was open to the industry,” Johnson said. “They are also pretty discriminating and selective, and they charge a hefty fee, so only a only small handful of clients have, as yet, been able to open accounts there.”

Encentus Federal Credit Union in Tulsa is also willing to accept deposits on behalf of the industry.

“Those are the two institutions that my clients have had some success in establishing banking relationships with, but again, for the obvious reason that those banks have to build out an extraordinary compliance infrastructure in order to accept these deposits, they pass on the cost of that infrastructure to the business. And so it’s a costly option,” Johnson said.

Tax burden

Another speed bump for the cannabis industry in Oklahoma is 280E of the Internal Revenue Code: “No deduction or credit shall be allowed for any amount paid or incurred during the taxable year in carrying on any trade or business if such trade or business (or the activities which comprise such trade or business) consists of trafficking in controlled substances (within the meaning of schedule I and II of the Controlled Substances Act) which is prohibited by Federal law or the law of any State in which such trade or business is conducted.”

So industry participants are left paying tax rates two to four times higher due to the federal prohibition.

Lawrence Cagigal is the southwest sales manager for Green Growth CPAs, a boutique accounting firm that specializes in cannabis businesses. || Alexa Ace

“>

Lawrence Cagigal is the southwest sales manager for Green Growth CPAs, a boutique accounting firm that specializes in cannabis businesses. || Alexa Ace

Lawrence Cagigal is the Southwest sales manager at Green Growth CPAs, a boutique accounting firm that works exclusively with the cannabis industry across 11 states with about 350 clients.

“It’s illegal, but the IRS’ standpoint is ‘Eff you; pay me.’ So that’s where 280E arose. Al Capone didn’t go to jail for gangster activity; he went to jail for tax evasion,” Cagigal said. “So everyone started paying taxes. So the government in the 80s said, ‘Well, here’s 280E. You can only write off cost of goods sold.’ 280E was built to curtail illicit drug runners, not necessarily to curtail business in states where it’s legal and people are doing it the right way.”

Because of the way the tax structure is set up, growers have the least tax burden while dispensaries have the highest. Processors are in the middle. Cannabis businesses will be stuck with a higher tax bill than most businesses.

“As an example, a cannabis dispensary and someone next door that’s a flower shop. So in essence, two different flowers. Someone that’s selling roses can deduct their employees’ time no problem, any advertising they do, the lights being on, the lights they buy. Anything in the store, that’s a normal business section. You don’t get that in the marijuana business,” Cagigal said. “It’s legal in the state of Oklahoma and other places. It’s illegal federally, but they’re still going to want their money and they’re going to make it hard on you. And so there to combat that, they just said you can’t deduct normal business expenses like everyone else because you’re Schedule 1. You can only write off cost of goods sold, which for dispensaries, basically, what you bought your flower for. You can’t deduct all this other stuff that’s out there. And everyone else can.”

Banks have to avoid running afoul of Financial Crimes Enforcement Network, or FinCEN, the U.S. Treasury Department’s enforcement agency. According to FinCEN, there were, as of March 2018, 411 financial institutions banking the industry, up from 318 in October 2016.

“FinCEN has offered pretty clear guidance as to how you can legally bank the industry,” Johnson said. “That compliance requires, for the average bank, additional personnel, additional training, the development of standard operating procedures, etc., that results in them incurring great expense. The reason that FinCEN requires that additional compliance infrastructure all boils down to federal prohibition, so short of recent scheduling or decriminalizing, some sort of act of Congress will be required to broaden access to the banking system on behalf of the industry. To me, that seems inevitable. There’s simply too much money being generated in this industry for financial institutions to not want their piece, for the government to not want a more secure way to ensure transparency in reporting so that the government gets its piece and for those lawmakers that are sympathetic to the industry to recognize that the security risk generated by our relative inability to access the banking system is untenable, long-term. So I think it’s pretty clearly a matter of time, and frankly, I am pretty optimistic that reform is pretty imminent.”

But because of those expensive fees, many smaller businesses are still handling large amounts of cash.

“‘Piles’ doesn’t do justice to the stacks of paper money that are being stored in secure locations across the state,” he said.

Previously published on Oklahoma Gazette.